A year deeply marked by high inflation, the energy crisis caused by the conflict in Ukraine, and by global supply chain's disruptions. In such context, many markets saw significant increases in wine prices which led to a slight decrease in volumes consumed worldwide, though overall value of global wine exports is the highest ever recorded.

«It's been a challenging period – said Pau Roca – The conflict in Ukraine is still going on, causing a general sense of uncertainty. We were also hit by financial vulnerability. We can't but state that we're living in a period of high inflation and very low growth. As to the wine sector, there has been an increasing of costs: logistics, raw materials, packagings. Deceleration has a depressing effect on consumptions, of course. But the wine sector must have the strenght to react, and face the future with imagination. There are always opportunities, it's a sector open to diversity and differentiation. The wine sector's resilience is strong, it's very flexible and quick to adjust to the market's new trends». So imagination is the key word for Pau Roca, something that can help thinking about new, different chances and paths to be undertaken by winemakers.

Global inflation is estimated to be decreasing consistently by next year (being at 6% in 2023, near 4% in 2024), but there are different challenges in sight. Like the wine health warnings that Ireland plans to put on labels: «Public health issues have been raised – said Roca – In the last years the OIV has been committing to reduce harmful wine consumption, and we're working to make clear that vineyard's fruits are legitimate and wine plays a key role in bringing wealth to rural areas».

Red wines seem to be facing a crisis: they've been constantly losing market to white wines, which benefitted from the boost by sparkling wines. Red wines' sales decreased from 53% to 48%, and though it's a global trend, in France the difference was far more than in other countries (-13/15%) and Italy too was affected. «There's a whole new generation of consumers, plus brand new climatic conditions», said Roca, and both affect the system.

De-alcoholized wines are another huge challenge. OIV is keeping this new, trendy category closely under observation: it's seen as an opportunity for producers, but for OIV the real issue is that beverages sold as de-alcoholized wines «are still 100% wines – said Pau Roca – It's a difficult innovation and a technological one. There must be no mysteries, customers don't want to be cheated. As OIV, we want to make sure that wine is properly de-alcoholized», and that the final product's quality matches the same level of the original wine's.

Pau Roca, President of the OIV

Pau Roca, President of the OIV World wine production: Italy's still first

An ongoing downward trend. World wine production in 2022 is estimated at 258 mhl, marking a slight decrease of 1% compared to 2021. In Europe, wine production is estimated at 161.1 mhl, +4% compared to 2021 and in line with its last five‐year average, despite a series of adverse weather events like spring frost, hail, excess heat, and drought experienced in most countries in 2022. Italy is still on top of the world wine production with 49.8 mhl, relatively stable as it's just -1% compared to 2021; it's followed closely by France (45.6 mhl) who recorded an impressive increase, +21%. Spain ranked third, followed by the US (-7%).

The world vineyard surface area is estimated to be 7.3 mha in 2022, a data that's been keeping stable since 2017, but varying sensibly depending on different areas. Italy, together with other major vine‐growing countries, such as China, Chile and Australia recorded stable surface areas, without significant changes with respect to 2021. Italy has 718 kha of surface area under vines and ranked fourth globally behind Spain (at the top), France (second) and China (third).

Consumption is been on a slowly decreasing trend in the last years, due to a string of unfortunate events. Lockdown measures and the consequent disruption of the HoReCa channel, plus an overall lack of tourism hit hard: in 2021, the uplifting of restrictions all over the world contributed to an increase in consumption in most countries.

World wine consumption in 2022 is estimated at 232 mhl (-2 mhl, that is -1% than 2021). This negative trend can be mainly attributed to the decline in China’s consumption, which has lost on average 2 mhl per year since 2018, and saw a dramatic drop in the last year: -16% compared to 2021 with an estimated 8.8 mhl. Italy ranked third (-5% with an estimated 23.0 mhl), while the US are still number one wine consumer globally, followed by France.

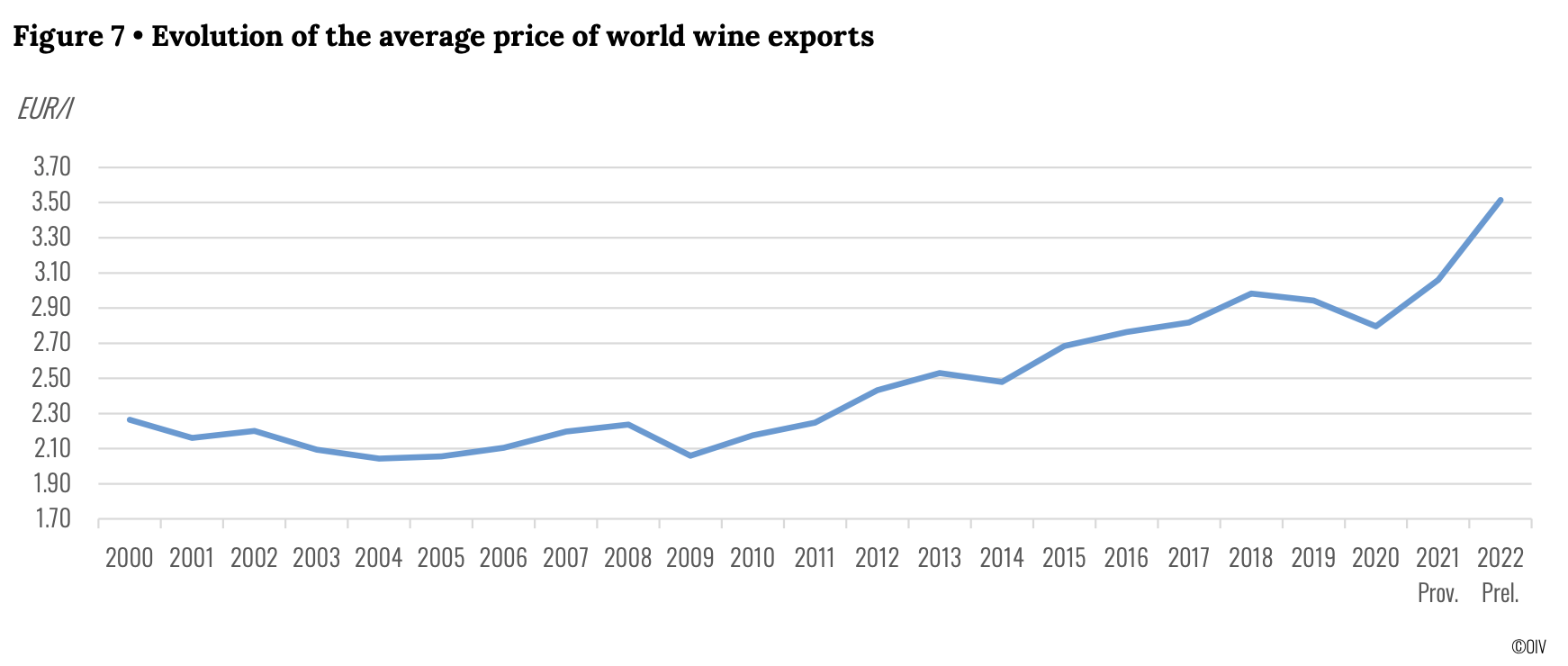

Wine exports in 2022 were severely impacted by high inflation and global supply chain disruptions, resulting in an overall lower volume of wine exported at a much higher average price (+15% compared to 2021), with global wine exports value estimated at 37.6 bn EUR, the highest figure ever recorded (+9%).

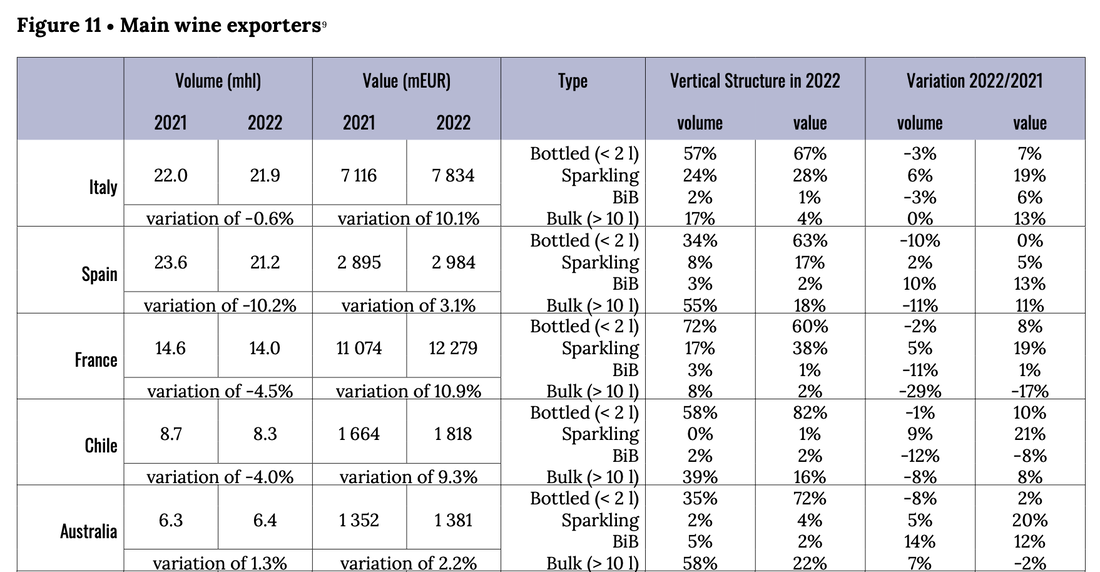

In 2022, global wine exports amount to 107 mhl (- 5%), with Italy still being the largest exporter in terms of volume with 21.9 mhl, accounting for 20% of the global exports. Italy also contributed to the rise in value at a wordl level (+717 m EUR / 2021), though France is the one who cashed in the most (+1.2 bn EUR / 2021).

In fact, overall bottled wine export has decreased by 4% in volume but increased by 7% in value as compared to 2021. Sparkling wine in particular has seen a very positive performance in 2022, being the only category that saw an increase both in terms of volume (+5%) and value (+18%). Sparkling wine represents only 11% of the global volume exported but accounts for 23% in global world exports value. France, Italy, and Spain – whose sparkling wine exports represent 17%, 24% and 8% of their total export volumes and 38%, 28%, and 17% of their total 2022 wine exports value respectively – confirm to be the top exporters of sparkling wine.

France remains the first exporter in terms of value with 12.3 bn EUR (+10.9% / 2021), followed by Italy (7.8 bn EUR, +10.1% / 2021) and Spain (3.0 bn EUR, +3.1% / 2021). These three countries account for 61% of the global exports in value. The largest importer by volume in 2022 are the US with 14.4 mhl (+3% compared to 2021), followed by Germany, (with 13.4 mhl, - 9,3%), and the UK, with a volume of 13.0 mhl, (‐2% / 2021).

RSS Feed

RSS Feed